The apartment market – looking for the rock bottom, but not losing optimism

2020-06-08

Based on the latest data, both negative and positive indicators were recorded in the apartment sales in the country and major cities in May 2020. The overall decline in the market activity in this housing segment can still be observed. According to the public enterprise Center of Registers, a total 1,865 purchase and sale transactions were registered in Lithuania in May this year, a 4% decrease compared to April. At the same time, this was the worst monthly result since January 2015. In Vilnius, the number of such transactions in May 2020 decreased by almost 12% compared to April 2020 and in Kaunas – by almost 9%, but the figure in Klaipėda unexpectedly increased by 30%.

“To give an idea of the level of activity of currently the largest housing segment in Lithuania, the apartment sales indicators in May can be compared to those of previous years,” Raimondas Reginis, Research Manager for the Baltics at Ober-Haus, said. The number of apartment transactions recorded in May 2020 compared to the monthly average in 2019 decreased by 37% in Lithuania (33% in Vilnius, 36% in Kaunas and 42% in Klaipėda). Historically, the overall activity in the apartment market in Lithuania returned to the levels of May 2011.

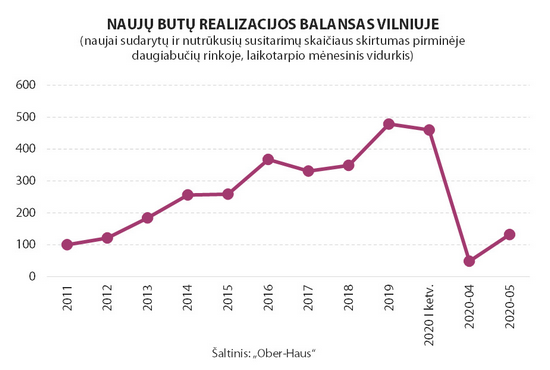

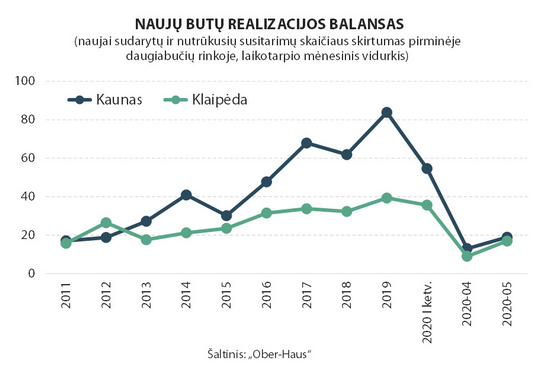

“If the total number of registered transactions for the purchase of apartments in Lithuania continued to decrease, so the sales balance of newly built apartments – the difference between the numbers of newly concluded and terminated agreements – showed the first positive signs in Vilnius, Kaunas and Klaipėda,” Reginis noted.

According to Ober-Haus, in May 2020, the sales balance in the primary market of apartments, calculating sold and reserved apartments, in Vilnius was 132 apartments or 2.8 times more than in April 2020. In Kaunas the number stood at 19 apartments (46% more than in April 2020) and in Klaipėda – 17 apartments (89% more than in April 2020).

A number of factors have contributed to the rise in the sales in the primary market of apartments. “First, a decrease in the number of new COVID-19 cases and the easing of the lockdown have given a little more confidence to potential home buyers who, returning to their normal life rhythm, became more interested in purchasing homes than they did in April. This is also reflected in the statistics on preliminary agreements, both in terms of the sales published by developers and in reserved properties. Second, after the extremely poor, almost symbolic performance in April this year in the sale of newly built apartments, the statistical improvement in May in the country’s major cities was not difficult to achieve,” Reginis said.

A number of factors have contributed to the rise in the sales in the primary market of apartments. “First, a decrease in the number of new COVID-19 cases and the easing of the lockdown have given a little more confidence to potential home buyers who, returning to their normal life rhythm, became more interested in purchasing homes than they did in April. This is also reflected in the statistics on preliminary agreements, both in terms of the sales published by developers and in reserved properties. Second, after the extremely poor, almost symbolic performance in April this year in the sale of newly built apartments, the statistical improvement in May in the country’s major cities was not difficult to achieve,” Reginis said.

However, the overall sales volumes continue to be very low. If we compare the average realization indicators of May 2020 with those of May 2019, we can see that the sales volumes fell 3.6 times in Vilnius, 4.4 times in Kaunas and 2.3 times in Klaipėda.

“The decrease in the sales volumes of newly built apartments and the number of terminated sales agreements for apartments in specific objects indicate that we are faced with the exceptional situation in the housing market,” Reginis said. If, before the global pandemic, termination of agreements occurred only in special cases, currently there are projects in the market with a negative overall monthly sales result, that is the number of new agreements regarding the purchase of the apartments was smaller than the number of terminated agreements.

Looking at the indicators of May 2020, a number of positive trends can be observed. According to the representative of Ober-Haus, although the volume of purchases of apartments continues to decrease, there are signals of stabilization and slowing down of the decline. The volumes of sales in the primary market of newly built apartments, in contrast, show that the interest of potential buyers in the new housing has not stopped and a further moderate return of buyers to this housing segment could be expected.

“The data of the primary and secondary markets of apartments over the next few months will show more precisely whether some potential buyers have withdrawn from the sector for a longer period or whether they have put their intentions on the back burner. One thing is clear, however, is that, in the situation where we are coping with the consequences of the pandemic, the search for the rock bottom in the housing market is still ongoing,” Reginis said.