The record high residential market activity in 2016 is only below the figures of 2004–2007

2017-03-30

The year 2016 was highly successful for the Lithuanian residential market. Given the current global challenges, the Lithuanian economy and the Lithuanian real estate market have demonstrated very good results. While 2013–2015 can be called the years of recovery of the real estate market, in 2016 the most economically active regions of the country passed to a quicker growth phase. Despite the overall positive moods in the country’s residential market however, the gap between the most economically active regions and regions experiencing serious demographic problems and main cities of these regions continued to widen. The number of operating construction cranes is a fairly accurate indicator of regions experiencing an economic growth and demonstrating a potential of development of residential projects. A positive factor was that, after a lengthy pause, Kaunas region, similarly to Vilnius, is demonstrating signs of recovery.

The year 2016 was highly successful for the Lithuanian residential market. Given the current global challenges, the Lithuanian economy and the Lithuanian real estate market have demonstrated very good results. While 2013–2015 can be called the years of recovery of the real estate market, in 2016 the most economically active regions of the country passed to a quicker growth phase. Despite the overall positive moods in the country’s residential market however, the gap between the most economically active regions and regions experiencing serious demographic problems and main cities of these regions continued to widen. The number of operating construction cranes is a fairly accurate indicator of regions experiencing an economic growth and demonstrating a potential of development of residential projects. A positive factor was that, after a lengthy pause, Kaunas region, similarly to Vilnius, is demonstrating signs of recovery.

According to data from the State Enterprise Centre of Registers, in 2016, the number of transactions of apartments in Lithuania was 13% higher and the number of transactions for houses was 7% higher than in 2015. The overall residential market activity in Lithuania in 2016 was only surpassed by indicators for the time period from 2004 to 2007. A historically high activity was recorded in Vilnius in 2016: in the course of the year, the number of transactions for apartments registered in the city increased by 13%, with the total number of sold apartments exceeding 11,000. This was historically the highest number of apartments sold per year, which exceeded the indicators of 2007 by 2%. The indicators of the other main Lithuanian cities for 2016 were also among the best over the past 9 years. The number of transactions for apartments in Kaunas and Klaipėda in 2016 increased by 10%; the growth was 9% in Šiauliai and 1% in Panevėžys. On the other hand, changes in the detached houses segment were both positive and negative, depending on the region. An increase in the number of transactions for houses was recorded in Kaunas, Šiauliai and Panevėžys – 10%, 28% and 34% respectively. A decrease in this number was recorded in Klaipėda and Vilnius – 5% and 9% respectively. However, despite the decrease in the number of transactions of houses in Vilnius, the 2016 results were among the best since 2004 (a higher number of transactions for houses was only registered in Vilnius in 2015).

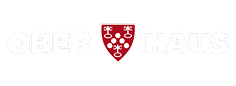

The residential market activity, which grew or remained high depending on the location, has resulted in the growth of both selling prices and rents. In 2016, the highest growth of apartment prices in all main Lithuanian cities since 2007 was recorded. According to data from Ober-Haus, in 2016, apartment prices in Vilnius grew on average by 6.8%. Prices of new apartments in Vilnius grew on average by 6.3%, while prices of old apartments grew by 7.3%. In Kaunas, Klaipėda, Šiauliai and Panevėžys, the growth of apartment prices in 2016 was 4.3%, 2.7%, 5.5% and 5.1% respectively.

The fastest growth in the prices of houses was recorded in Vilnius and its surroundings, where in the course of the year the prices increased on average by 6%. An average growth of 2% of house selling prices was recorded in Kaunas and Klaipėda regions. Average prices of houses in Šiauliai and its suburbs did not change in 2016, and a decrease of 2% was recorded in Panevėžys.

In 2016, an average 2–5% growth of apartment rents was recorded in all main Lithuanian cities. Despite the growing supply of housing for rent in Vilnius, mainly positive changes in apartment rents were recorded in 2016. Although prices in the most expensive housing segment have remained stable, in the most active housing segment (in which rents are between 200 and 400 EUR per month) rents grew on average by 2–4%. The growth of rents in 2016 was slower than the growth of selling prices, but the growing apartment acquisition prices and the high demand for housing ensure a sufficiently high activity in the housing rental segment. In 2016, the average rent for a 1–3 room apartment in Vilnius was 379 EUR/month; this figure was 283 EUR/month for Kaunas, 272 EUR/month for Klaipėda, 150 EUR/month for Šiauliai, and 115 EUR/month for Panevėžys.

An increasing number of new market players undertake apartment building construction projects

In the current situation, the main reasons for the market activity and for the growth of housing prices remain the same as in previous years and include the growing incomes of the population, the ultra-low mortgage rates, and the stable interest in investing in housing on the part of the population. The population’s expectations about the future are also an important factor, as people continue to evaluate their financial well-being and price change trends. Population surveys show that people in the main regions of the country expect housing prices to continue to increase in the foreseeable future. SEB bank Housing Price Indicator shows that, at the end of 2016, as many as 55% of Lithuanian respondents expected housing prices to increase over the next twelve months (at the end of 2015, this figure was 52%). Only 12% of the respondents expected the prices to drop (this figure was 13% one year ago), while 23% of the respondents expected that the prices would not change (this figure was also 23% one year ago). Consideration of individual regions shows that the greatest share of residents expecting price growth – 69% – live in Vilnius County. Residents of the other counties are less optimistic and, depending on counties, 36% to 54% of residents expect an increase in housing prices. The percentage of people expecting a further increase in housing prices in some counties has even dropped.

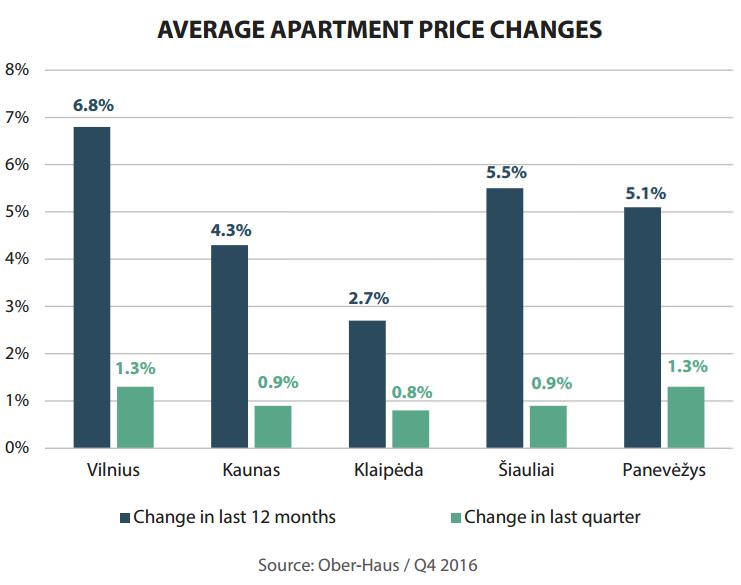

In 2016, growing investments in the Lithuanian residential sector were recorded once again, with investments in new buildings demonstrating the fastest growth pace. According to data from the Lithuanian Department of Statistics, in 2016, the works of construction (new construction, reconstruction, repair, restoration and other works) of residential buildings for EUR 477 million were performed (21% of all construction works), which is a 13% increase compared to 2015 (if 2015 prices are considered). If only the volume of new construction is taken into account, the growth in 2016 was as high as 32%.

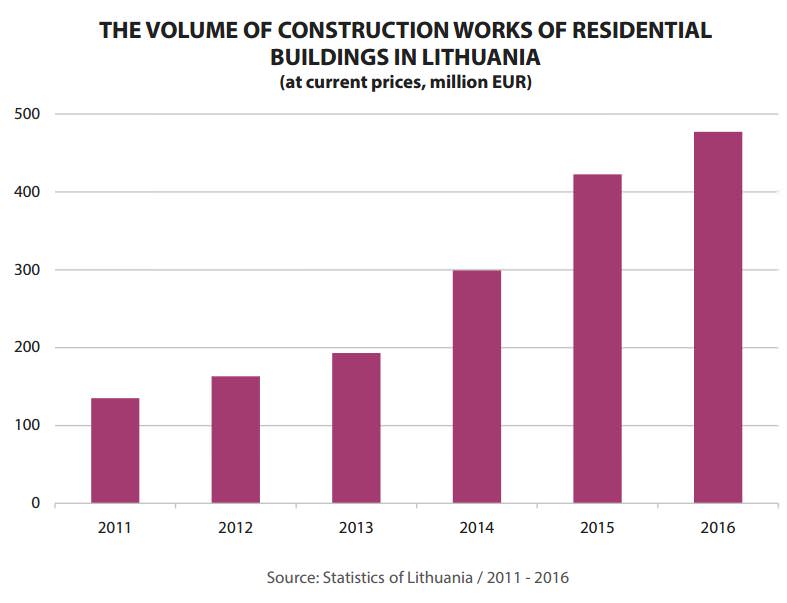

According to data from Ober-Haus, in 2016, 3,709 new apartments were constructed in Vilnius, which is a 4% increase compared to 2015. A total of 49 apartment building projects or project stages were implemented in Vilnius in 2016. The number of apartments built in 2016 was the highest since 2008, when developers built 5,471 apartments in Vilnius. The 2016 apartment building projects demonstrated a rich diversity (in terms of quantity, locations and quality). The growth of the share of prestigious (most expensive) apartments in the total annual supply (projects in which the price of apartments without final fit-out is above 2,000 EUR/sqm) was the most rapid: in 2016, it increased from 8% to 13%. These projects offer apartments in the most prestigious parts of Vilnius, i.e. the city centre, the Old Town, and other prestigious districts. The share of middle-class apartments (projects in which the price of apartments without final fit-out is from 1,450 EUR/sqm to 1,900 EUR/sqm) decreased from 59% to 48% in the course of the year. In 2016, the share of economy-class apartments (projects in which the price of apartments without final fit-out is up to 1,400 EUR/sqm) increased from 33% to 39%. The supply of apartments in Vilnius in 2016 can be viewed as fairly balanced, i.e. all the segments were able to offer buyers a sufficient number of apartments.

Although, in 2016, the apartment construction market in Vilnius was dominated by experienced developers, the number of apartment building projects developed by new companies without any history has also increased. Experienced companies, each of which has completed at least 3–4 apartment building projects, constructed 58% of apartments in Vilnius in 2016 (in 2015, this figure was 64%). Less experienced companies (each of which has completed 2–3 projects) constructed 21% of all apartments (the figure for 2015 was 26%). The share of apartments constructed by new companies, which do not have any reliable housing development history (i.e. have completed only one project or are only beginning their operations), has increased from 10% to 21%. It is therefore advisable for buyers to conduct a responsible evaluation of the seller of a particular housing they would like to buy. In 2017, developers will continue to attract buyers with a rich supply of properties: plans are to construct at least 4,000 new apartments in Vilnius in the course of the year.

Certain changes in the supply of new housing have been observed in recent years not only in the market for apartments but also in the market for detached and semi-detached houses. The increasing incomes of the population and the growing need for a larger living space encourage developers to direct some of their investments in the development of houses. Particularly distinct changes are recorded in Vilnius and its surroundings. While 2012 and 2013 can be viewed as the start of a recovery of construction of apartment buildings in Vilnius, an active development of neighbourhoods of detached and semidetached houses started in 2014 and 2015. In 2016, developers built nearly 320 new houses in Vilnius and its surroundings, which is a 39% increase compared to 2015. This was the highest annual supply indicator since 2007, when nearly 490 houses were supplied to the market. Developers are going to offer an even wider selection of both semi-detached and detached houses in the nearest future. In 2017, the total number of built and ready-to-sell houses in Vilnius and its region may reach 400. The new house selling indicators are viewed by developers fairly optimistically: by the end of 2016, 73% of houses constructed in the course of the year were either sold or reserved.

A leap in the supply of new apartments is expected in Kaunas in 2017

In 2016, a growth in the supply of new construction projects was also recorded in Kaunas and Klaipėda. According to data from Ober-Haus, 311 apartments were built in Kaunas in 2016, which is a 26% increase compared to 2015. Seven apartment building projects or project stages were implemented in Klaipėda in 2016, which offered 202 apartments (a 55% increase compared to 2015). Although a rapid relative growth in the supply was recorded in these cities in 2016, yet the total number of apartments constructed there has remained fairly modest compared to the 3,709 apartments built in Vilnius. The year 2017 may become a breakthrough year for Kaunas however, as developers’ plans and projects in progress promise a rocketing increase in the number of new apartments in this city. Fifteen to twenty new apartment building projects or project stages could be implemented in Kaunas in 2017, which could offer the market from 600 to 800 new apartments. If this happens, it will be a major supply leap since 2008. The abundance of projects in progress (in particular as far as large-scale and more expensive projects are concerned) shows that developers have regained trust in the Kaunas residential market. A growth in the apartment market in Klaipėda is also expected in 2017, but the total number of apartments built in the course of the year will hardly be above 300.

The growth in the volume of construction of new apartments in Šiauliai and Panevėžys in 2016 was very slow. No new apartment buildings were built in Šiauliai in the course of the year, and two new buildings of the low-rise construction project in Molainių Street were completed in Panevėžys. Despite investor promises to resume the construction of suspended apartment buildings or start some small-scale projects in these cities, the very low liquidity of new apartments hinders the development of any major projects. The year 2017 will not be absolutely resultless for Šiauliai and Panevėžys, and 4 small-scale projects or project stages with approximately 35 apartments are likely to be completed (in Dvaro Street in Šiauliai and in Molainių, Suvalkų and Kranto streets in Panevėžys).

The lowest number of unsold apartments over the past 9 years

The lowest number of unsold apartments over the past 9 years

The activity in the market for new apartments and the indicators achieved in 2016 were truly satisfactory for developers. According to data from Ober-Haus, over 5,229 new apartments in completed apartments buildings and apartment buildings in progress were purchased or reserved directly from developers in the five main Lithuanian cities in the course of 2016. This was a nearly 33% increase compared to 2015. The significant growth has resulted not only from the positive moods in the housing market, but also from the increasing apartment supply in Vilnius, Kaunas and Klaipėda. New projects expand the choice for potential buyers: whereas earlier some buyers were unable to find a property satisfying their needs, the current variety of locations and quality parameters can attract an increased number of buyers. In 2016, 4,341 new apartments were either sold or reserved in Vilnius, which is a 33% increase compared to 2015. In 2016, 514 new apartments (a 42% increase compared to 2015) were sold/reserved in Kaunas and 346 new apartments (a 22% increase compared to 2015) were sold/reserved in Klaipėda. 28 new apartments in completed apartment buildings or apartment buildings in progress were sold/reserved in Šiauliai and Panevėžys, and the same figure was recorded in these cities in 2015.

The active sales have resulted in a decrease of vacant apartments in completed apartment buildings in all main Lithuanian cities. By the end of 2016, the total number of unsold apartments in completed apartment buildings in the main Lithuanian cities was 1,741, which is a 28% decrease compared to the figure recorded one year ago. By the end of 2016, 1,016 apartments were offered for sale in apartment buildings in Vilnius built in 2007–2016 (there were 1,464 vacant apartments by the end of 2015); this figure was 239 for Kaunas, 466 for Klaipėda, and 20 for Šiauliai and Panevėžys taken together. This was the smallest number of unsold apartments since 2008, and it seems evident that, given the current market situation, developers are not pressed by the unsold ‘balance’ and are actively planning other residential projects.