The new apartment price record in Vilnius after almost 14 years

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), was up by 1.6% in September 2021 (an increase of 2.4% was recorded in August 2021). The overall price level of apartments in the major cities has in the past 12 months increased by 19.4% (an increase of 17.9% was recorded in August 2021).

The Ober-Haus Lithuanian apartment price index (OHBI), which records changes in apartment prices in the five major Lithuanian cities (Vilnius, Kaunas, Klaipėda, Šiauliai and Panevėžys), was up by 1.6% in September 2021 (an increase of 2.4% was recorded in August 2021). The overall price level of apartments in the major cities has in the past 12 months increased by 19.4% (an increase of 17.9% was recorded in August 2021).

In September 2021, apartment prices in the capital city rose 1.8% and the average price per square meter reached EUR 1,986 (+35 EUR/sqm). In Kaunas, Klaipėda, Šiauliai and Panevėžys, prices in September increased by 2.0%, 0.8%, 0.8% and 0.6% respectively and the average price per square meter increased to EUR 1,401 (+28 EUR/sqm), EUR 1,344 (+10 EUR/sqm), EUR 907 (+7 EUR/sqm) and EUR 892 (+5 EUR/sqm) respectively.

The prices of apartments in the major cities saw a double digit increase on a year-over-year basis in September 2021: in Vilnius – 19.9%, Kaunas – 19.5%, Klaipėda – 17.7%, Šiauliai – 19.0% and Panevėžys – 19.2%.

“September 2021 was symbolic for the residential property market of the capital city of Lithuania – after a very rapid increase in sales prices of apartments, the average square meter price in Vilnius reached an all-time high,” Raimondas Reginis, Market Research Manager for the Baltics at Ober-Haus, said.

According to Ober-Haus, the highest price per square meter in Vilnius was last time recorded in December 2007 and stood at EUR 1,983 (EUR 1,986 in September 2021). However, a more detailed comparison of the prices of apartments shows that prices in different segments (both according to the year of construction and location) have increased at a different rate over the past decade. For example, at present, the prices of new apartments are on average by 3.5% higher than at the end of 2007, and the prices for older apartments are still by 2.6% lower.

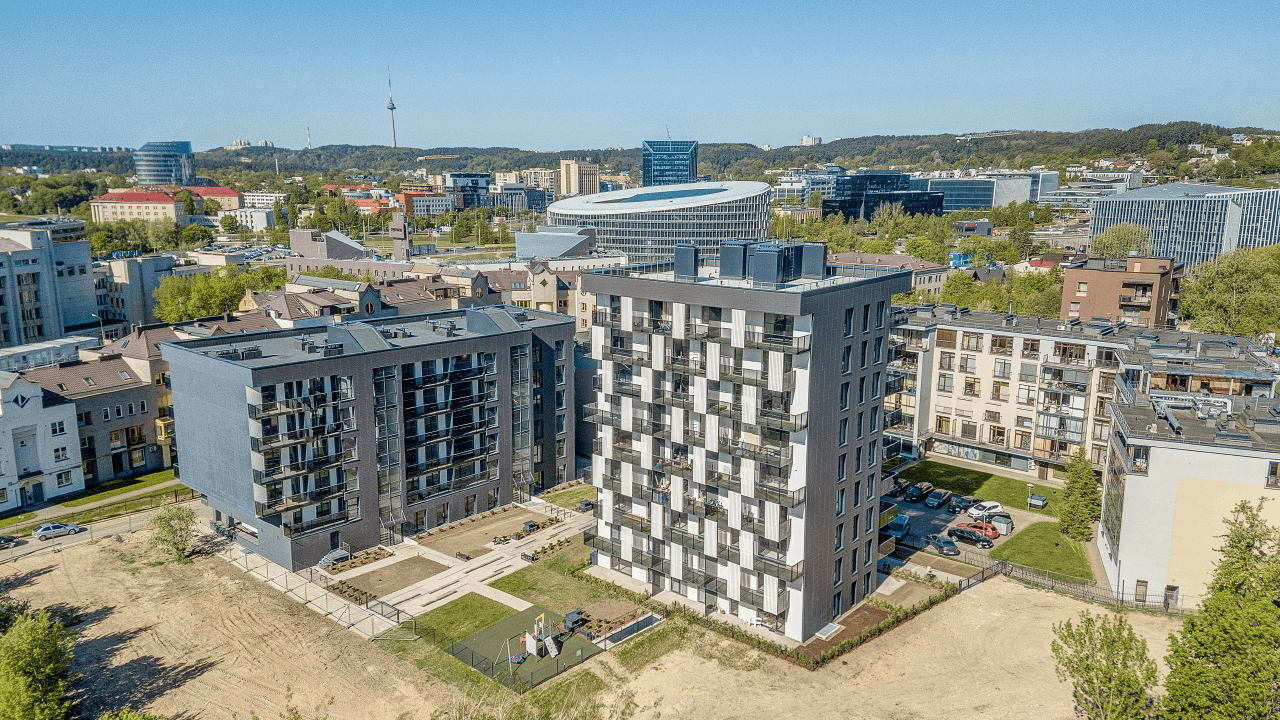

Looking in greater detail, it is clear that the sales prices of apartments in both old and new apartment buildings located in the central part of the city (the Old Town, Užupis, Naujamiestis) and adjacent areas (Šnipiškės, Žvėrynas) have most rapidly increased and even exceeded the prices recorded at the end of 2007. “This is what could have been expected, because these urban areas have seen a lot of positive changes over the past decade, which also affected the attractiveness of property market. The conversion of industrial sites into new apartment blocks and business centres, new hard and soft landscaping and road infrastructure have attracted huge interest from people with higher incomes and caused an increase of real estate prices in these urban areas to unprecedented levels,” Reginis noted.

Record prices, however, were recorded not in all apartment segments in Vilnius. For example, the prices of apartments in the Soviet-era buildings, the largest segment of apartment buildings in the city, are slightly below the 2007–2008 level. According to Reginis, such apartments may be up to 10% cheaper than at the very peak of prices. This segment has the greatest impact on the estimates of the average sales price of apartments in Vilnius.

For example, the analysis of all recorded apartment purchase and sale transactions in Fabijoniškės district, one of the largest apartment building districts in Vilnius, shows that in July-September 2021, the median price per square meter of 1–4-room apartments in the buildings constructed in 1987–1991 was about 5% lower compared to the prices of apartments sold in November 2007–January 2008. At the end of 2007 and the beginning of 2008, a 2-room apartment sold on average for EUR 88,000, and in July-September 2021 – for EUR 75,000. Meanwhile, a 3-room apartment sold on average for EUR 101,000 and EUR 91,500 during the same period.

Karoliniškės district, for example, one of the oldest typical districts in Vilnius, were construction of multi-storey panel buildings started in the early 1970s. According to Ober-Haus, in July-September 2021, the median price per square meter of 1–4-room apartments in the buildings constructed in 1972–1975 was about 11% lower compared to the prices of apartments sold in November 2007–January 2008. At the end of 2007 and the beginning of 2008, a 2-room apartment sold on average for EUR 83,000, and in July-September 2021 – for EUR 73,000. Meanwhile, a 3-room apartment sold on average for EUR 94,000 and EUR 86,000 during the same period.

“We can see that over the past decade, Vilnius has been changing rapidly – it has expanded and has become more densely populated. In terms of the real estate market, certain districts became more attractive and buyers pay for the property more than ever before. Meanwhile, in the districts where there have been fewer changes, the same property costs less than before the global financial crisis,” Reginis commented.

It is obvious that typical apartment block districts in the city face major challenges, because they are already formed and changes that would make them more attractive and increase property prices are neither fast nor visible. It should also be taken into consideration that buildings are getting older. For example, this year, Vilnius City Municipality has launched the CITY+ programme for revitalising residential districts aimed at renewing apartments, buildings, yards, and streets and creating centres of attraction and identity of these districts. The renovation of old apartment buildings alone can increase their attractiveness on the market and increase the value of the apartments (even with investment costs in mind), furthermore, it will be beneficial to the residents of such districts who could live in more beautiful and warmer homes.

“Despite the slightly uneven increase in prices in different apartment segments of the capital city, it is clear that prices of apartments have been rapidly increasing across the city over the past decade. Since the lowest sales price level recorded in May 2010, prices have increased by as much as 72% on average. High market activity and optimistic expectations of market players allow us to predict even higher price levels at least in the near future,” Reginis said.

Full review (PDF): Lithuanian Apartment Price Index, September 2021

Latest news

All news

All news

Ober-Haus completes the sale of…

A. Juozapavičiaus Street, Kaunas, the last apartment in the project…

In 2024, annual apartment price…

The Ober-Haus Lithuanian apartment price index (OHBI), which follows changes…

Up to two times the…

“As the level of house prices has been rising slowly…

All news

All news